Preventing owners and highly compensated employees from abusing retirement plans’ tax benefits is one of the primary policy goals of the Employee Retirement Income Security Act. One way ERISA accomplishes this is grouping certain commonly owned business entities together as a single employer for plan testing. These rules are referred to as the Affiliated Service Group [hereinafter ASG] rules and Control Group rules.

Why are ASG and Control Group rules important?

The existence of an ASG or Control Group can greatly impact a plan. While designing a plan to accommodate the existence of an ASG or Control Group is straightforward, discovering that an existing plan is sponsored by a member of an ASG or Control Group often results in plan sponsors needing to make additional contributions to the plan and expanding plan participation.

As noted above, plan sponsors can easily avoid these costly penalties by using a plan designed to accommodate the existence of an ASG or Control Group, but to do this, a sponsor first needs to know what ASGs and Control Groups are. The rules governing these groups are complex. Because of this, the remainder of this article will focus exclusively on ASGs, while a companion article covers Control Groups.

What are Affiliated Service Groups?

At a basic level, Affiliated Service Groups are groups of companies that are connected via a commonly owned, service-oriented company and that provide services to one another. One common example is a group of independent medical practices who jointly own a scheduling company that provides these scheduling services to separate medical practices.

More specifically, an ASG must contain one or more First Service Organizations and at least one A-Organization or B-Organization. People often refer to these three organizations as FSOs, A-Orgs, and B-Orgs.

How does a company determine if it is a member of an ASG?

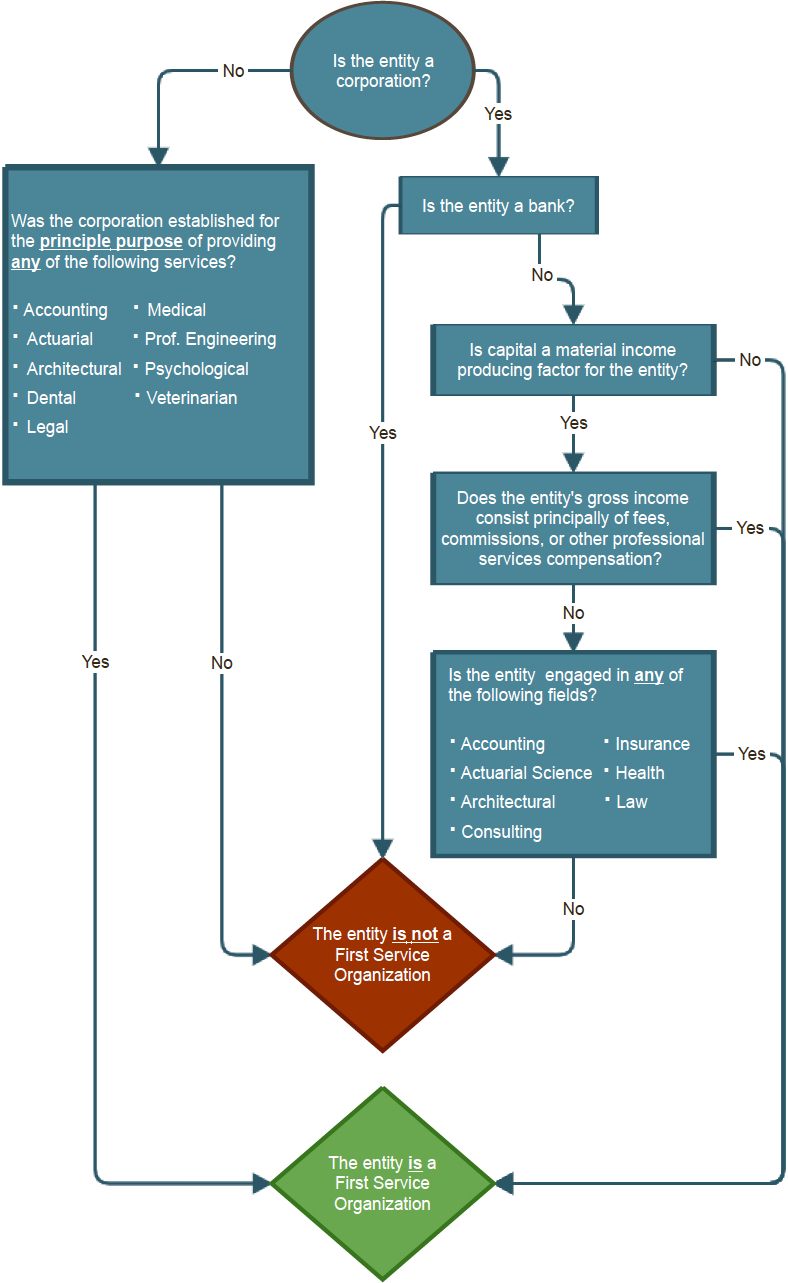

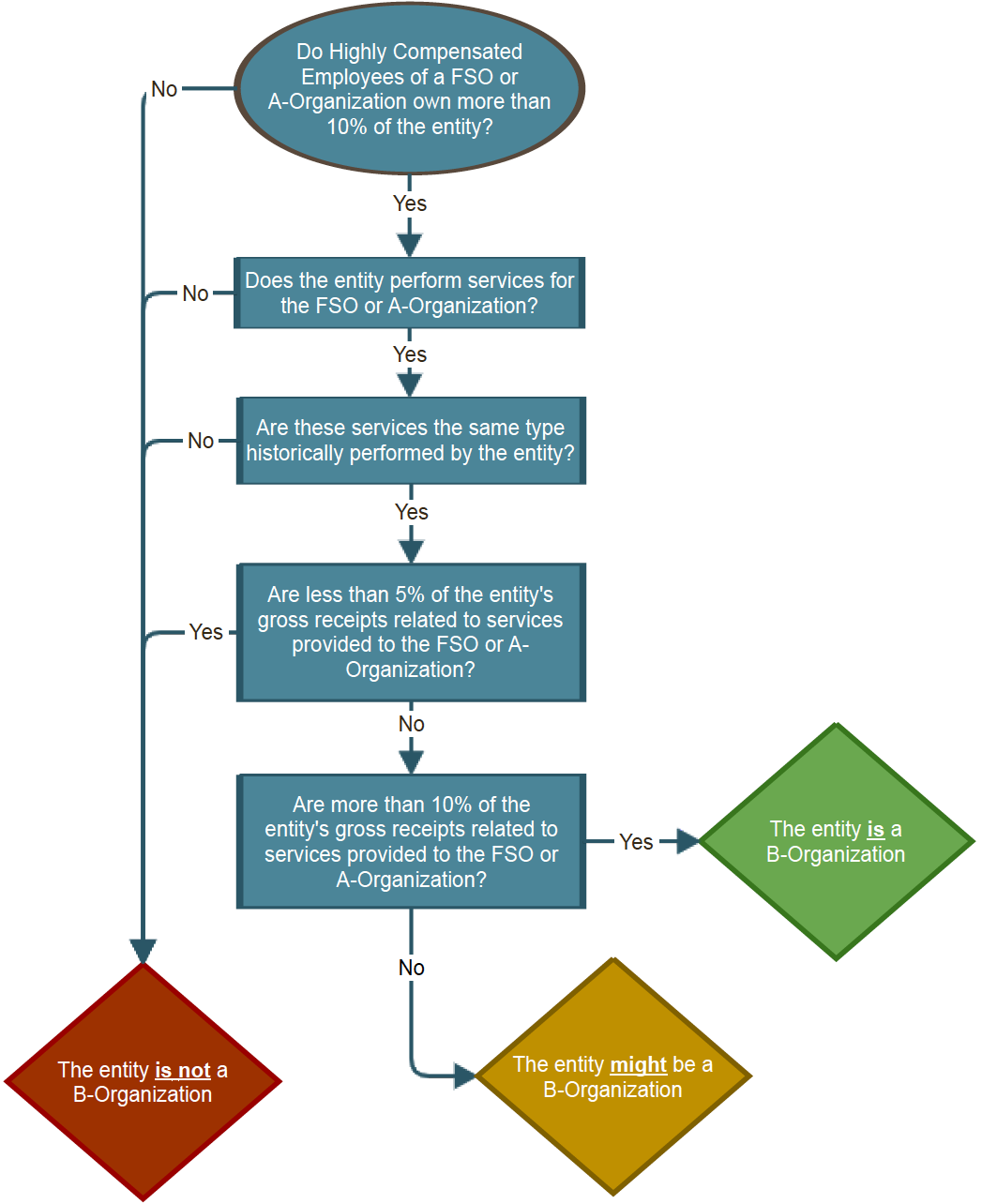

In order for a company to determine if it is part of an ASG, the company must determine if it or any other companies with a shared ownership interest are a FSO, A-Org, or B-Org. When conducting this analysis, it is important to note that the tests used to determine if a FSO, A-Org, or B-Org exists are heavily dependent on the facts and circumstances of each situation. That being said, applying the following flowcharts to each entity sharing some amount of common ownership is a good place to begin.

Step 1: Identify First Service Organizations (FSOs)

The first step of determining if an ASG exists, is to determine what, if any, entities tied to the plan sponsor are FSOs. This is because if none of the entities are a FSO, then an ASG does not exist.

Step 2(A): Identify A-Organizations (A-Orgs)

If an FSO is identified in step 1, then analysis moves to step 2(A): identifying all A-Orgs.

Step 2(B): Identify B-Organizations (B-Orgs)

Regardless of step 2(A)’s results, if step 1 identifies a FSO, then analysis should continue to step 2(B): identifying all B-Orgs.

Step 3: Mapping the ASG

After all of the FSOs, A-Orgs, and B-Orgs are identified, they must be sorted into Affiliated Service Groups. When doing this, it is helpful to remember that an ASG only exists if there are

- One or more FSOs and

- One or more A-Orgs or B-Orgs

This means that when there is no FSO then there is no ASG. Likewise, if no A-Orgs or B-Orgs exists, then there is no ASG.

To illustrate, consider the earlier example involving independently owned medical practices that use a jointly owned scheduling company. In this example, each of the independent practices is a FSO and the jointly owned scheduling company could be an A-Org.

As you can see, the only thing holding the group together is their shared connection to the scheduling company. If that entity did not exist, or if the practices did not jointly own the scheduling company, then the ASG would not exist.

The above example follows a clean hub and spoke model, but ASG groups are not always this clean. Things can become complicated if one of the “spokes” is part of its own ASG. This is because the rules require all overlapping ASGs to be linked together. For example, assume Medical Practice 5 jointly owns a human resources company with a private investment group, and assume both outsource human resources to the HR company.

In this example, Medical Practice 5, the HR company, and the private investment group would normally form their own ASG, as would the five medical practices and the scheduling company; however, because Medical Practice 5 is a member of both ASGs, federal law considers all eight employers to be a single employer for testing purposes. This means any plan sponsored by one of these eight companies would need to account for the other seven entities’ employees when conducting year-end testing.

Check out our next article: Identifying Related Employers: Part I – Affiliated Service Groups