There are two major types of Related Employers: Affiliated Service Groups and Control Groups. Part I of this series discussed the general purpose of Related Employer rules, how they affect plan testing, and explained Affiliated Service Groups.

Why are the Control Group rules important?

As noted in Part I, ERISA considers all entities that are part of a Control Group or Affiliated Service Group to be a single employer. While being part of a Control Group or Affiliated Service Group is not inherently bad, discovering that a company sponsoring a plan is part of a Control Group after a plan is adopted often results in plan sponsors needing to make additional contributions and expanding plan participation.

What are Control Groups?

Control Groups are a type of Related Employer. More specifically, they are networks of commonly owned companies.

How does a company determine if it is a member of Control Group?

A company is part of a Control Group if it satisfies one of two ownership tests. These tests are known as the parent-subsidiary test and brother-sister test. If two or more entities satisfy either of these tests, then those entities are part of a Control Group.

Because both of these tests deal with ownership, it is important to collect some information before conducting the tests. Specifically, it is important to determine who the owners are and how much of the company they own.

How is direct ownership measured?

A person’s direct ownership of an entity is equal to the greater of the value of her ownership stake and the amount of voting power tied to her ownership stake.

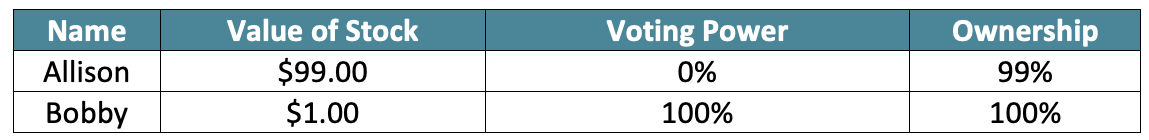

For example, assume a company is worth $100, Allison owns non-voting shares worth $99.00, and that Charlie owns voting shares worth $1.00.

In this example, the value of Allison’s stock determines her ownership percentage, while the amount of voting power held by Bobby determines his ownership percentage.

What other types of ownership are there?

In addition to direct ownership, there is also attributed ownership. Attributed ownership occurs when a person is credited with another person or entity’s ownership. Attribution can occur through familial relationships and through organizations.

Familial attribution

As noted above, people must sometimes count their family member’s ownership percentages as their own. The below chart lays out these conditions.

Family Attribution Example 1:

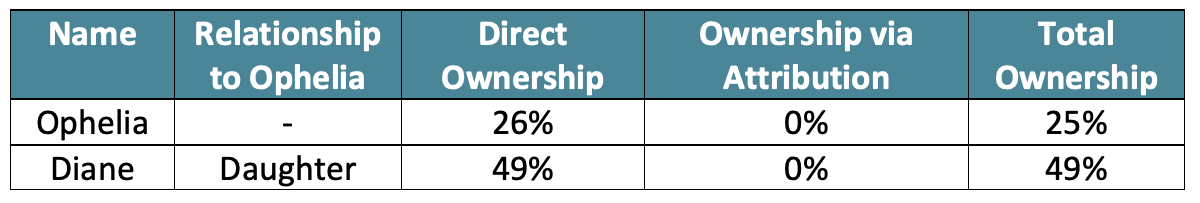

Assume during the plan year

- Ophelia owned 26% of a company

- Ophelia’s daughter, Diane, owned 49% of the company

- Diane is 30 years old

Under this example, no ownership is attributed to Ophelia or Diane because Diane is over age 21 and neither owns more than 50% of the company.

Family Attribution Example 2:

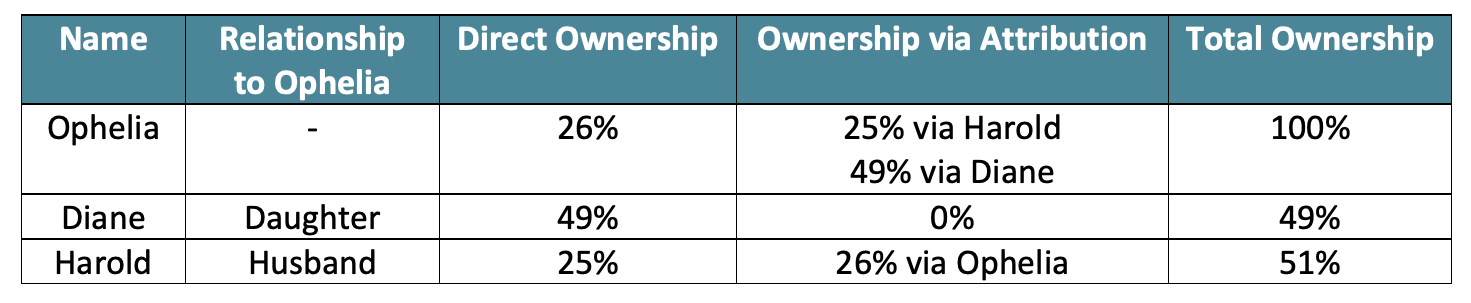

Using the same assumptions as above, also assume

- Ophelia’s husband, Harold, owned 25% of the company

- Harold is not Diane’s father and has not adopted her

Under this example, Ophelia’s ownership increases to 100% because she is married to Harold. Because the two of them are married, she is credited with his ownership, increasing her ownership to more than 50%. Because her ownership rises above 50%, she must also count Diane’s ownership as her own.

Harold on the other hand, does not need to count Diane’s ownership in this example because he is not Diane’s father and stepparents are not credited with unadopted stepchildren’s’ ownership.

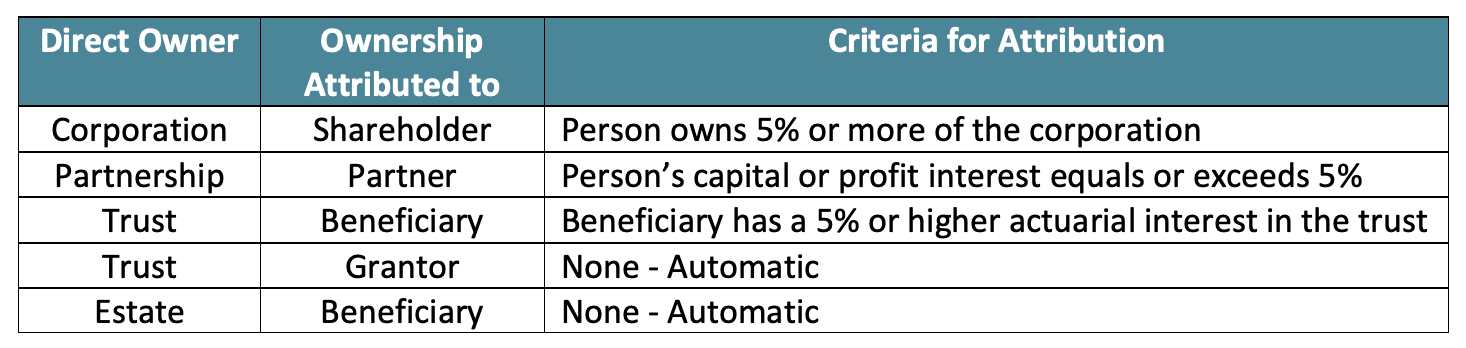

Organizational attribution

In addition to counting family member’s ownership percentages, some people must count an organization or business’s ownership percentage as their own.

The parent-subsidiary test

After collecting information about direct and indirect ownership, an organization can conduct the two ownership tests. While it does not matter which test is performed first, we begin with the parent-subsidiary test because it is simpler.

Generally, under the parent-subsidiary test, an organization is considered part of a Control Group if a single person or organization owns at least 80% of a company. The one exception relates to something called the § 415 limit.[1]

Under this exception, the threshold drops from greater than or equal to 80% to greater than 50%.

As an example, assume Oscar owns

- Oscar owns 100% of Company A

- Oscar owns 51% of Company B

- Oscar’s wife, Wendy, owns 29% of Company B

- Oscar owns 60% of Company C

Under this scenario, Company A and Company B are part of the same Control Group because Oscar owns 80% or more of both. In addition to this, Oscar’s contributions in each entity’s retirement plan must be combined for § 415 testing.

The brother-sister test

The other ownership test is known as the brother-sister test. While the parent-subsidiary test focuses on one entity or person’s ownership, the brother-sister test looks at group ownership.

Under this test, an entity is part of a Control Group if five or fewer people own 80% or more of a company and the sum of each person’s minimum ownership exceeds 50%.

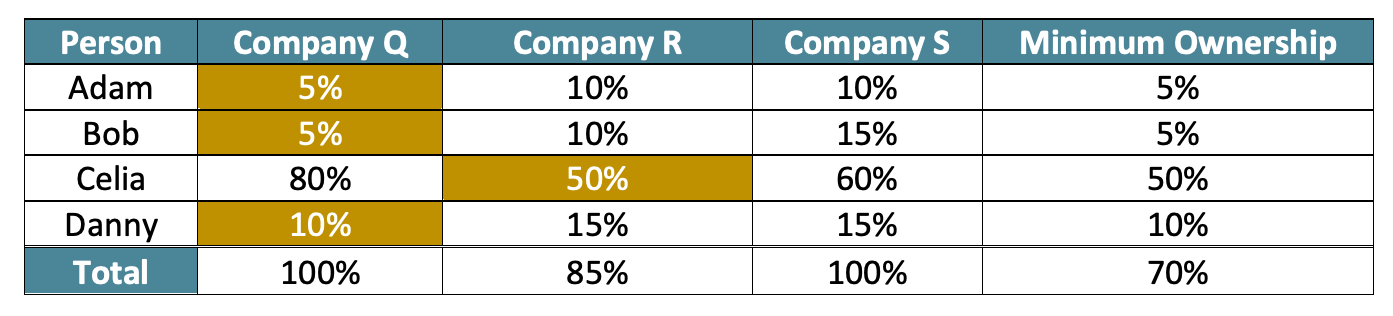

As an example, consider the below table. The percentages represent a person’s total ownership in that company, and each person’s minimum ownership percentage is highlighted.

As you can see above, the group’s combined ownership of each company is at least 80% and their combined minimum ownership across all three companies is greater than 50%. Because of this, all three companies are considered part of the same Control Group.

Mapping the Control Group

After conducting both tests, the only piece left is to map the Control Group. To do this, every entity that satisfies either test is linked together like a chain, and every entity making up part of that chain is considered part of the same Control Group.

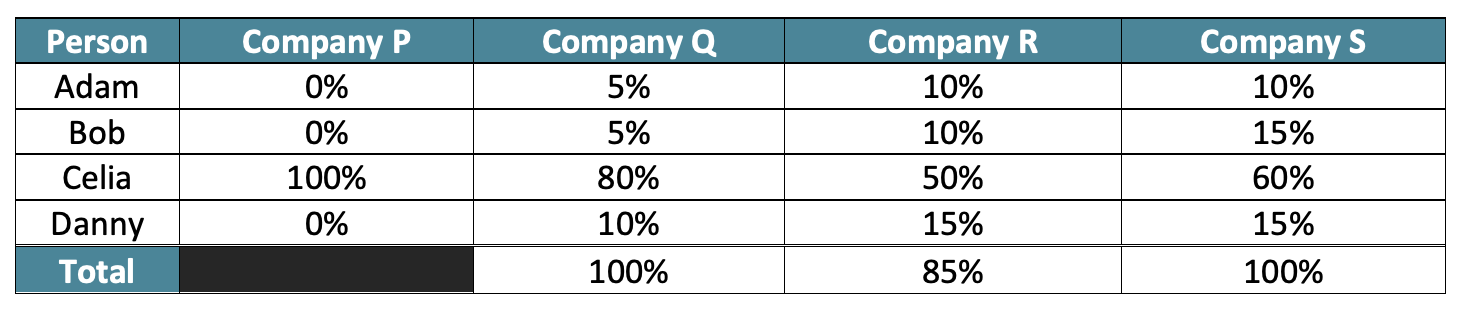

As an example, assume

- The same ownership breakdown as the above brother-sister example

- Person A also owns 100% of Company P

In this example, all four companies are part of the same Control Group because of Celia. Specifically,

- Companies Q, R, and S pass the brother-sister test

- Companies P and Q pass the parent-subsidiary test

Without Celia’s ownership in Company P and Company Q, there would be no link between the two groups.

Missed Part I? Catch up here.

[1] The § 415 limit sets a cap on the amount of contributions a person may receive in a retirement plan during a plan year. Under the Control Group rules, this limit is assessed using contributions made through every member of that Control Group. For example, if a person receives $5,000 in profit sharing from company A, receives another $5,000 in profit sharing from Company B, and both companies are part of the same Control Group, then that person is treated as having received $10,000 for § 415 purposes.